rental property vs rolex | are rental properties beneficial rental property vs rolex Rental real estate also offers several tax advantages, including depreciation, which can help offset some of your taxable income. Depreciation is the act of deducting a portion . See more Atbalsts klientiem Sazināties ar mums uz DEPO.lv. . naglas un stiprinājumi Apgaismojums un elektroinstalācija Apdares materiāli Durvis, logi un kāpnes Troses, ķēdes, auklas, celšanas un vilkšanas aprīkojums Vannas istaba un sanitārie mezgli Virtuves iekārtas, .

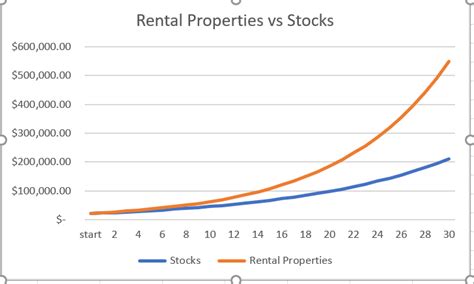

0 · share market vs rental property

1 · rental property vs stock market

2 · investing in rental property

3 · index funds vs rental properties

4 · are rental property investments profitable

5 · are rental properties worth it

6 · are rental properties good investments

7 · are rental properties beneficial

Delfi.lt naujausios žinios, politika, verslas, sportas, pramogos, orai, horoskopai, TV programa, piliečių nuomonės ir komentarai, nuotraukos ir video. . Ikea (prekės ženklas IKEA) - privati multinacionalinė kompanija, didžiausia baldų gamintoja pasaulyje bei mažmenininkė, prekiaujanti baldais, aksesuarais, vonios bei virtuvės .

The ultimate goal of retirement is to have diversified sources of income that provide you with more to live off of for longer. Ideally, you'll have saved a sizable sum of money in a traditional retirement account or through your company's 401(k), that will complement Social Security or any pension you may be eligible . See moreReal estate, generally speaking, appreciates over time. In normal conditions, appreciation is in the range of 4% annually, meaning for most properties, you can expect the . See more

Rental real estate also offers several tax advantages, including depreciation, which can help offset some of your taxable income. Depreciation is the act of deducting a portion . See moreMany people shy away from owning rental propertybecause they are concerned about managing it. Listing the property for rent, showing the property, signing leases, collecting rent, and if necessary, evicting tenants is a part of owning rental property. But thankfully, you . See more Real estate proponents advocate for potentially robust monthly cash flow, price appreciation, and tax advantages, whereas index fund adherents cite minimal expenses, a . Owning a rental property can be financially rewarding. There are tax benefits to consider such as deducting insurance costs, mortgage interest, and maintenance costs. But .

share market vs rental property

Explore the pros and cons of owning a rental property vs. investing in the stock market. Discover why property is a popular investment and the psychological benefits it offers.

white body richard mille replica dhgate

A key part of deciding whether to invest in rental property is determining how much money you have to spend—and whether you’ll pay in cash or take out a mortgage. Stock investors will tell you that rental properties require a lot of work, tenants may damage the property, rents will get unpaid, and that you could even get sued.

It turns out that rental properties are a better investment than stocks in the long run — and I can prove it with numbers. Being a landlord is a much more hands-on investment than owning shares of a REIT. Many people who have gotten into the business of purchasing rental properties have .Both REITs and rental properties allow investors to take an active role in real estate investments. Let's compare the benefits and drawbacks of both.

It comes down to a choice between investments: Keep a positive-cash-flow rental property or cash in the equity and roll it into our long-term Bogle-style index funds. The single-family home . Rental property can create additional income streams, both now and well into retirement. Owning rental property creates the opportunity of appreciation as well as tax benefits. Real estate proponents advocate for potentially robust monthly cash flow, price appreciation, and tax advantages, whereas index fund adherents cite minimal expenses, a lack of constant oversight,. Owning a rental property can be financially rewarding. There are tax benefits to consider such as deducting insurance costs, mortgage interest, and maintenance costs. But there are also drawbacks .

Explore the pros and cons of owning a rental property vs. investing in the stock market. Discover why property is a popular investment and the psychological benefits it offers. A key part of deciding whether to invest in rental property is determining how much money you have to spend—and whether you’ll pay in cash or take out a mortgage. Stock investors will tell you that rental properties require a lot of work, tenants may damage the property, rents will get unpaid, and that you could even get sued.

It turns out that rental properties are a better investment than stocks in the long run — and I can prove it with numbers. Being a landlord is a much more hands-on investment than owning shares of a REIT. Many people who have gotten into the business of purchasing rental properties have quickly learned that the.

Both REITs and rental properties allow investors to take an active role in real estate investments. Let's compare the benefits and drawbacks of both. It comes down to a choice between investments: Keep a positive-cash-flow rental property or cash in the equity and roll it into our long-term Bogle-style index funds. The single-family home is mortgaged through 2040 at 3.25%. Rental property can create additional income streams, both now and well into retirement. Owning rental property creates the opportunity of appreciation as well as tax benefits. Real estate proponents advocate for potentially robust monthly cash flow, price appreciation, and tax advantages, whereas index fund adherents cite minimal expenses, a lack of constant oversight,.

Owning a rental property can be financially rewarding. There are tax benefits to consider such as deducting insurance costs, mortgage interest, and maintenance costs. But there are also drawbacks . Explore the pros and cons of owning a rental property vs. investing in the stock market. Discover why property is a popular investment and the psychological benefits it offers.

A key part of deciding whether to invest in rental property is determining how much money you have to spend—and whether you’ll pay in cash or take out a mortgage. Stock investors will tell you that rental properties require a lot of work, tenants may damage the property, rents will get unpaid, and that you could even get sued. It turns out that rental properties are a better investment than stocks in the long run — and I can prove it with numbers. Being a landlord is a much more hands-on investment than owning shares of a REIT. Many people who have gotten into the business of purchasing rental properties have quickly learned that the.

Both REITs and rental properties allow investors to take an active role in real estate investments. Let's compare the benefits and drawbacks of both.

The long awaited Delilah, the breathtaking supper club from H.Wood Group opening at Wynn Las Vegas, gets ready to showcase its stunning decor, over-the-top menu, and sublime cocktails on July 14.

rental property vs rolex|are rental properties beneficial